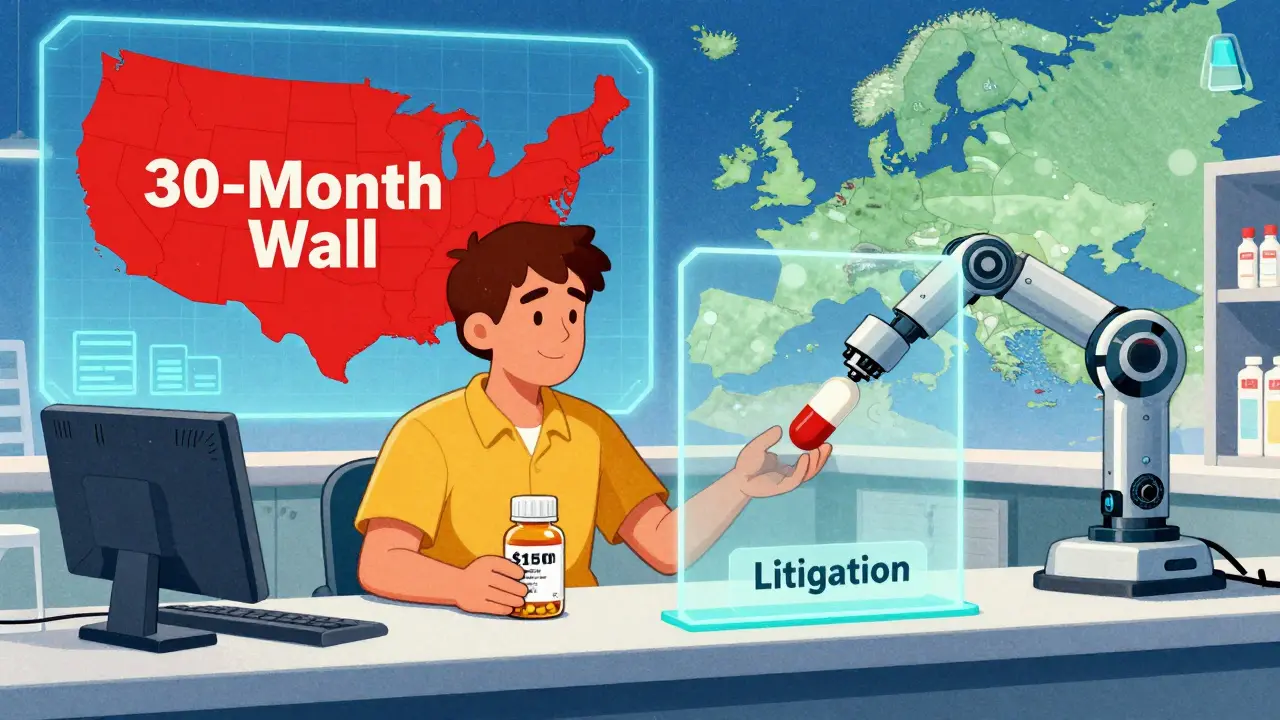

When a brand-name drug hits the market, it doesn’t just have a patent-it has a legal shield. That shield is called the 30-month stay, and it’s the single biggest roadblock standing between patients and affordable generic drugs in the U.S. This isn’t a glitch. It’s a feature of the 1984 Hatch-Waxman Act, designed to balance innovation and access. But today, it often looks more like a delay machine.

How the 30-Month Stay Actually Works

Here’s the simple version: When a generic drug maker wants to sell a cheaper version of a brand drug, they file what’s called an ANDA-a simplified application with the FDA. If they believe the brand’s patents are invalid or won’t be infringed, they file a Paragraph IV certification. That’s a legal challenge. The moment they do that, they must notify the brand company. If the brand sues within 45 days, the FDA is legally blocked from approving the generic for up to 30 months.

That’s the stay. It’s automatic. No judge needs to rule. No hearing is required. Just a lawsuit filed, and the clock starts. During those 30 months, the FDA can still review the generic application. They can even give it tentative approval. But they can’t say yes-final approval is frozen.

Here’s the twist: The 30 months isn’t always the end. If the lawsuit drags on past that point, the stay can extend. Courts can shorten it. But more often, they let it run. And in 2022, the FDA granted tentative approval to 78% of ANDAs still in litigation. That means hundreds of generics were ready to go-but stuck on hold.

Why It’s Not Just About 30 Months

Most people think the delay ends when the 30 months are up. It doesn’t. The median gap between the end of the stay and the actual launch of the generic? 3.2 years. Why?

Because the real delay isn’t legal-it’s commercial. Generic companies spend millions preparing for litigation. They need to build supply chains, negotiate with retailers, set pricing. Some wait to launch until after the first generic enters the market, hoping to piggyback on lower prices. Others delay because the brand company files a second lawsuit on a different patent-something the 2003 Medicare law tried to stop, but loopholes still exist.

Take a drug like Humira. It had over 100 patents listed in the FDA’s Orange Book. Even though only one triggered the initial 30-month stay, the brand used the system to keep generics out for over a decade. That’s not litigation-it’s strategy.

The First-Mover Advantage That Backfires

The Hatch-Waxman Act gave the first generic company to challenge a patent a 180-day exclusivity window. No one else can enter during that time. Sounds fair, right?

Not always. Sometimes, the first filer doesn’t launch at all. They settle with the brand company for cash or a deal to delay entry. That’s called a “pay-for-delay” agreement. The FTC found that 78% of Paragraph IV lawsuits ended in settlements that pushed generic entry past patent expiration. In 2021, these deals cost U.S. consumers $13.9 billion in extra drug spending.

And when multiple generics do file? The system works better. Drugs with more than one Paragraph IV challenger reach the market 8.2 months faster than those with just one. Competition forces faster launches. But the first filer still holds the keys.

How the U.S. Is Alone in the World

Nowhere else does this happen. In the EU, generics can launch as soon as data exclusivity ends-no lawsuits needed. Canada has a 24-month stay, but it’s not automatic. It requires a court order. The U.S. is the only country that lets a single lawsuit freeze FDA approval for two and a half years.

That’s why the FDA’s own data shows U.S. generic entry is slower than in Europe by an average of 18 months for the same drugs. And it’s why countries like India and China now make 63% of all ANDA submissions-they know the U.S. system is predictable, even if it’s slow.

Who Pays the Price?

The cost isn’t just financial. It’s human.

Diabetes, cholesterol, blood pressure-these are daily meds. When a generic is delayed, patients pay 10 times more. The average brand drug costs $150 a month. The generic? $15. That’s $1,620 a year saved per person. Multiply that by millions of patients, and you get $195 billion in potential savings over the next few years, according to Evaluate Pharma.

But the system isn’t broken-it’s being exploited. A 2019 Brookings study found that 67% of patents listed in the Orange Book for top-selling drugs were filed after the original approval. These are minor changes: a new coating, a different pill shape, a slightly altered dose. They’re not innovations. They’re legal tricks to reset the clock.

What’s Changing?

Pressure is building. In 2023, Congress introduced the Affordable Prescriptions for Patients Act. It proposes cutting the stay from 30 months to 18 and banning stays for secondary patents. The FTC is pushing for the same. The FDA’s new draft guidance wants brand companies to prove every patent listed in the Orange Book is truly relevant.

Generic manufacturers are spending $3-5 million per ANDA just on legal fees. One Teva executive told a forum: “We’ve seen the 30-month stay create false security. The litigation drags on, but the real delay is our own internal readiness.”

Meanwhile, brand companies argue that without the stay, they’d never invest in new drugs. Scott Gottlieb, former FDA commissioner, says the system has saved consumers $2.2 trillion since 1984. But Harvard’s Aaron Kesselheim counters: “It’s added 1.8 years of exclusivity on average for blockbuster drugs.”

The Bottom Line

The 30-month stay was never meant to be a tool for endless delay. It was meant to give innovators time to defend their patents-not to build a wall around their profits. Today, it does both. The FDA approves generics. The courts don’t always rule. And patients wait.

Reform is coming. Whether it’s faster, fairer, or just more honest, the system is under fire. And for the 90% of U.S. prescriptions filled with generics, the question isn’t whether change will happen. It’s whether it’ll happen before the next patent cliff hits.

By 2028, $78 billion worth of brand drugs will lose patent protection. If the 30-month stay stays the same, those drugs will stay expensive. If it changes, millions could finally get the meds they need-at prices they can afford.

Pooja Kumari

January 7, 2026 AT 19:33Let me tell you something about India’s generic drug industry - we don’t play games. We don’t file 100 patents on a pill coating. We make life-saving meds affordable. When I was in Delhi last year, my mom got her insulin for $2 a vial. In the US? $300. That’s not capitalism, that’s exploitation. The 30-month stay? It’s a corporate chokehold. And yeah, I’m mad. Not just because I care - because I’ve seen people skip doses because they can’t afford the brand. This isn’t about innovation. It’s about greed dressed up in legal jargon.

Johanna Baxter

January 8, 2026 AT 04:12So the system’s broken? Wow. Shocking. Next you’ll tell me billionaires pay less taxes. 😂

Jerian Lewis

January 9, 2026 AT 19:14The Hatch-Waxman Act was a compromise. It worked for decades. Now we’re blaming the law because pharma found loopholes? That’s like blaming the hammer because someone used it to break a window. Fix the loopholes, not the tool. The FDA already has the power to reject frivolous patents. They just don’t use it. Lazy regulators. Not lazy laws.

Kiruthiga Udayakumar

January 11, 2026 AT 06:53India makes 63% of ANDA submissions? Good. That means we’re not just making pills - we’re making justice. The US system is a joke. You patent a color change and lock patients out for a decade? That’s not innovation, that’s theft. And if you think generics are dangerous, go ask a diabetic in Bihar. They don’t care about your patent rights. They care about living. The FDA should stop listening to pharma lobbyists and start listening to patients. We’ve been doing this right for 40 years. You’re just catching up.

Patty Walters

January 11, 2026 AT 08:48Just a heads up - the 78% tentative approval stat? That’s huge. Means the FDA’s doing its job. The problem’s not the agency, it’s the lawsuits. And the pay-for-delay deals? Those are straight-up bribery. FTC’s been screaming about it for years. Congress just doesn’t wanna tick off Big Pharma. I’ve worked in pharma compliance. I’ve seen the spreadsheets. It’s not complicated. It’s criminal. And yes, I misspelled some words. I’m tired. And so are patients.

Phil Kemling

January 11, 2026 AT 21:59Here’s the real question: Why do we equate innovation with monopoly? If a drug saves lives, why should its price be dictated by legal theater? The 30-month stay isn’t protecting innovation - it’s protecting profit margins. And we’ve built an entire economy around pretending that’s moral. We call it capitalism. But when the market is rigged by lawsuits and patent thickets, it’s not a market. It’s a casino. And the house always wins - while patients lose insulin, blood pressure meds, antidepressants. We’ve turned healthcare into a game of chess. But the pieces are people.

tali murah

January 12, 2026 AT 09:38Oh look. Another ‘woke pharma exposé.’ Let me guess - the author works for a generic manufacturer. Or worse, a ‘health equity’ nonprofit funded by George Soros. The 30-month stay? It’s called ‘due process.’ You want generics? File your ANDA. Challenge the patent. Win in court. Or don’t. That’s how it works in a free society. If you can’t afford your meds, maybe don’t take 10 different ones. Or move to India. They’ll sell you insulin for $2. And yes, I’m being sarcastic. Because this whole article is performative outrage with footnotes.

Diana Stoyanova

January 13, 2026 AT 15:52Y’all need to stop treating this like some abstract policy debate. This is LIFE. I had a cousin with rheumatoid arthritis. Her brand drug cost $5,000/month. Generic? $400. But the 30-month stay delayed it for 2 years. She sold her car. She maxed out her credit card. She cried every time she had to choose between rent and meds. And then? The generic finally launched - and the first filer didn’t even release it for 6 months because they got paid to wait. 🤬 We’re not talking about shareholders here. We’re talking about people who can’t breathe because their lungs are inflamed and their bank account is empty. This isn’t politics. It’s survival. And we’re failing.

Jenci Spradlin

January 13, 2026 AT 21:38Big Pharma’s got a whole playbook: file 100 patents, settle with the first generic, drag out litigation, wait for the next patent to expire, rinse, repeat. Teva’s exec said it right - the real delay is their own readiness. They’re scared to launch because they know the brand will sue again. So they wait. And patients wait. The fix? Limit the number of patents you can list. Ban pay-for-delay. End the automatic stay. Simple. Congress just needs balls. And maybe a few less lobbyist dinners.

Elisha Muwanga

January 13, 2026 AT 23:55Why are we letting foreign countries dictate our drug policy? India and China make 63% of ANDAs? That’s a national security risk. We used to make medicine here. Now we outsource our health to factories in Bangalore and Shanghai. The 30-month stay? It’s not perfect, but it protects American innovation. If you want cheap drugs, go buy them overseas. But don’t tear down our system just because you can’t afford the price tag. We built this country on hard work - not handouts disguised as ‘affordable care.’

Maggie Noe

January 15, 2026 AT 16:51Imagine if your Netflix subscription got delayed because someone sued the company for ‘copying the logo.’ That’s what’s happening here. The FDA says ‘yes’ - but the courts say ‘wait.’ And patients? They’re stuck in limbo. 🥺 I’m not anti-innovation. I’m pro-life. If a pill has the same active ingredient, same dosage, same safety profile - why is it still a crime to sell it? The patent system was never meant to be a time machine that locks away medicine for 18 extra years. We’re not protecting science. We’re protecting stock prices. And honestly? I’m done pretending this is fair. 💔