When a patient with multiple sclerosis switches from a $78,000-a-year brand-name drug to its generic version costing $45,000, the savings are obvious. But for the pharmacist dispensing it, the real challenge isn’t the price tag-it’s the specialty pharmacy system behind it. Unlike your local retail pharmacy, where generics are swapped in automatically, specialty pharmacies deal with medications so complex that even a small change can trigger patient anxiety, clinical risk, or administrative chaos.

What Makes Specialty Pharmacy Different?

Specialty pharmacy isn’t just about expensive drugs. It’s about drugs that need special handling, constant monitoring, and deep patient support. These are medications for conditions like cancer, rheumatoid arthritis, hepatitis C, and HIV-diseases that don’t just need treatment, they need management. Many are biologics: large, complex molecules made from living cells. They can’t be copied like a small-molecule pill. That’s why, for years, most specialty drugs had no generic alternatives. But that’s changing. Patents are expiring. Biosimilars-generic-like versions of biologics-are hitting the market. As of December 2023, the FDA had approved 35 biosimilars. The first interchangeable biosimilar, Semglee for insulin, was approved in 2021. That means pharmacists now have to understand not just how to dispense these drugs, but when and how they can be substituted.Generics in Specialty Pharmacy: Not the Same as Retail

In a typical pharmacy, 90% or more of prescriptions are filled with generics. It’s routine. In specialty pharmacy? It’s rare. Why? Because most specialty drugs still don’t have generics. But when they do, the stakes are higher. Take glatiramer acetate, used for multiple sclerosis. The brand version, Copaxone, cost about $78,000 a year. The generic? Around $45,000. That’s a 42% savings. Sounds great. But here’s what happens behind the scenes:- The patient’s pill looks different-color, shape, markings.

- The inactive ingredients (excipients) changed.

- The patient calls, panicked: “This isn’t my medicine!”

Narrow Therapeutic Index Drugs: The High-Risk Zone

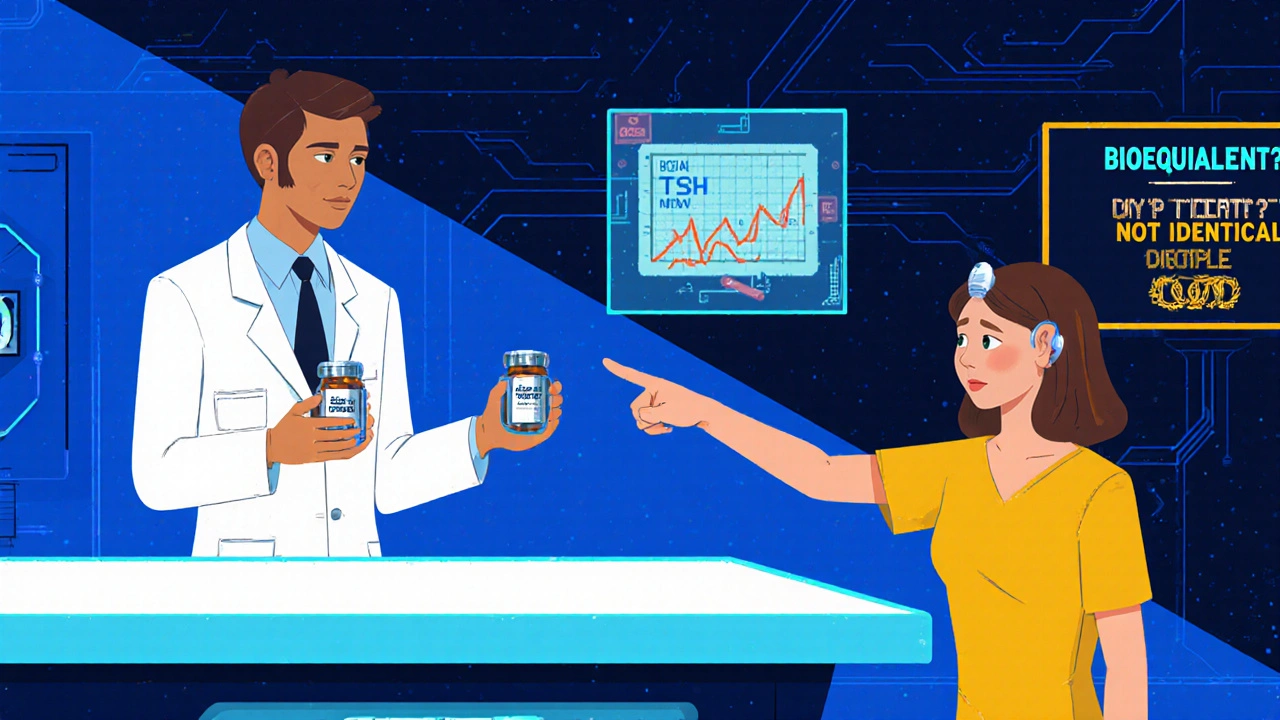

Some drugs don’t play nice with substitutions. These are called narrow therapeutic index (NTI) drugs. A tiny change in blood concentration-just 5%-can cause treatment failure or serious side effects. Levothyroxine, used for hypothyroidism, is a classic example. Patients on levothyroxine who switch between generic manufacturers often report fatigue, weight gain, or heart palpitations-even though the FDA says they’re bioequivalent. Reddit threads from the r/pharmacy community in early 2023 were full of patients describing these exact issues. One wrote: “I was stable for years on one generic. Switched to another. My TSH spiked. Took three months to get back to normal.” For NTI drugs, many experts recommend staying on the same manufacturer once a patient is stabilized. That’s not just a preference-it’s a clinical strategy. Specialty pharmacies must track not just the drug name, but the manufacturer and lot number. That’s not standard in most retail systems.

Pharmacy Benefit Managers Are Making It Harder

It’s not just patients who are confused. Pharmacists are caught in the middle. Pharmacy Benefit Managers (PBMs) often set Generic Dispensing Ratio (GDR) targets. If a specialty pharmacy doesn’t hit a certain percentage of generics dispensed, they get penalized. But here’s the problem: if there’s no generic for a drug, you can’t dispense one. Yet PBMs still penalize you. A 2023 report from Frier Levitt found that some PBMs reimburse specialty pharmacies below the actual cost of acquiring the drug. That’s unsustainable. Add to that the complexity of tracking multiple generic manufacturers for the same drug-each with different packaging, billing codes, and supply chains-and you’ve got a logistical nightmare. McKesson Medical-Surgical recommends that specialty pharmacies adopt a “focused generics strategy with a dedicated distributor.” Why? Because sourcing from multiple suppliers creates administrative chaos. One pharmacy in Ohio reported spending 15 hours a week just reconciling invoices and matching generic brands to patient records. That’s 15 hours not spent counseling patients.Biosimilars: The New Frontier

Biosimilars are the closest thing to generics for biologics. They’re not exact copies-because biologics can’t be copied exactly-but they’re highly similar and proven to work the same way. The first biosimilar for Humira (adalimumab) launched in the U.S. in 2023 after years of patent battles. But adoption is slow. Why? Because PBMs often place biosimilars on higher tiers than the brand. That means patients pay more out of pocket-even though the drug costs less. One patient in Texas told her pharmacist: “I’m paying $1,200 a month for the biosimilar. The brand was $1,100. Why switch?” Specialty pharmacies are on the front lines of biosimilar education. They have to explain the difference between a biosimilar and a generic. They have to document patient consent. They have to track whether substitution is allowed by state law-and whether it’s required by the PBM. The Congressional Budget Office estimates biosimilars could save the U.S. healthcare system $54 billion over the next decade. But that savings won’t happen unless pharmacists are equipped to manage the transition.What Specialty Pharmacies Need to Do Now

If you’re running or working in a specialty pharmacy, here’s what you need to act on:- Map your top therapeutic areas. Start with the most common conditions you serve-MS, cancer, hepatitis C. Identify which drugs have generics or biosimilars now, and which will soon.

- Standardize your inventory. Don’t stock five different generic versions of the same drug. Pick one preferred manufacturer per product, based on evidence, reliability, and patient feedback.

- Build a substitution protocol. When can you substitute? When can’t you? Document contraindications-like excipient allergies or NTI concerns. Make sure your EHR tracks this.

- Train your staff. Every technician and pharmacist needs to know how to explain a generic switch without triggering panic. Use simple language: “It’s the same medicine, just made by a different company.”

- Monitor after substitution. For NTI drugs or biosimilars, schedule follow-ups. Check labs. Call patients. Don’t assume they’re fine just because the prescription filled.

Patients Are Watching

A 2014 study on specialty pharmacy services for MS patients found that medication adherence jumped from 33% to 60% when patients received consistent counseling and support. That’s not because of the drug-it’s because of the care. Patients don’t care about PBM rebates or formulary tiers. They care if their medicine works. If they feel heard, if they understand why a change was made, they’ll stick with it. Specialty pharmacy isn’t just about dispensing drugs. It’s about managing uncertainty. It’s about balancing cost savings with clinical safety. And it’s about building trust-when every pill change could feel like a gamble to the person taking it.The Future Isn’t About More Generics. It’s About Smarter Substitutions.

The era of automatic generic substitution is over in specialty pharmacy. The future belongs to pharmacies that can navigate complexity with clarity. That means knowing which drugs can be swapped, which can’t, who needs monitoring, and how to explain it all without jargon. The savings are real. The risks are real too. The job of the specialty pharmacist isn’t to push generics. It’s to protect the patient through every change-no matter how small the pill looks.Can generic drugs be substituted for specialty biologics?

No, traditional generics cannot be substituted for biologics because biologics are complex proteins made from living cells. Instead, biosimilars-highly similar but not identical versions-are used. These require separate approval pathways and substitution rules under the Biologics Price Competition and Innovation Act (BPCIA). Only interchangeable biosimilars, like Semglee, can be substituted without prescriber approval in some states.

Why do patients react badly when switched to a generic specialty drug?

Patient reactions often stem from changes in pill appearance-color, shape, or markings-due to different inactive ingredients (excipients). Even though the active ingredient is identical, patients may believe they’re getting a lower-quality drug. This is especially common with narrow therapeutic index drugs like levothyroxine, where small changes in blood levels can cause symptoms like fatigue or heart palpitations. Counseling and consistency in manufacturer selection help reduce these concerns.

Are all generic drugs the same quality?

The FDA requires all generics to meet the same standards for strength, purity, and bioequivalence as brand-name drugs. Facilities are inspected and products tested. However, some clinicians and pharmacists report variability in patient outcomes when switching between different generic manufacturers, particularly for narrow therapeutic index drugs. This may relate to differences in excipients or manufacturing processes not fully captured by bioequivalence testing.

Why do PBMs penalize specialty pharmacies for low generic dispensing rates?

Many PBMs use Generic Dispensing Ratio (GDR) metrics to measure cost savings across all pharmacies. But specialty pharmacies often dispense drugs with no generic alternatives-like biologics or complex injectables. Penalizing them for not meeting GDR targets ignores the clinical reality of specialty care. This creates financial strain and operational conflict, as pharmacies are forced to choose between financial penalties and appropriate patient care.

How can specialty pharmacies manage multiple generic manufacturers?

Specialty pharmacies should standardize on one preferred manufacturer per generic product whenever possible. This reduces inventory complexity, simplifies labeling, and minimizes patient confusion. Partnering with a single distributor who can guarantee supply continuity and consistent product quality is recommended by McKesson Medical-Surgical. Robust documentation systems are also needed to track manufacturer changes and flag patients with allergies or sensitivities to specific excipients.

What role does medication therapy management (MTM) play in specialty generics?

MTM is critical. Specialty pharmacists use MTM to monitor adherence, manage side effects, educate patients on substitutions, and coordinate with prescribers. For patients on generics or biosimilars, MTM helps detect early signs of instability-like lab changes or symptom recurrence-and intervene before treatment fails. Studies show MTM improves adherence by up to 27% in specialty populations.

Nikhil Purohit

November 22, 2025 AT 00:08Man, I’ve seen this play out in my clinic - patient switches to generic glatiramer, panics because the pill’s blue instead of green. We spent 20 minutes on the phone just explaining it’s the same damn drug. The FDA says it’s bioequivalent, but patients don’t care about bioequivalence - they care that their body doesn’t feel like it’s falling apart.

Debanjan Banerjee

November 23, 2025 AT 09:39Let’s be clear: the FDA’s bioequivalence standards are a joke for NTI drugs. A 5% variation in levothyroxine absorption can send TSH through the roof. Bioequivalence doesn’t mean pharmacological equivalence. The system is built on the assumption that pills are interchangeable widgets - but human physiology isn’t a vending machine. This isn’t about cost - it’s about clinical negligence disguised as efficiency.

Steve Harris

November 24, 2025 AT 09:29As someone who’s worked in specialty pharmacy for 18 years, I’ve seen the chaos firsthand. PBMs don’t care about clinical outcomes - they care about rebate percentages. We’re stuck between a rock and a hard place: penalized for not hitting generic targets, but legally barred from substituting when there’s no generic. The solution? Stop using GDR as a KPI for specialty. It’s like measuring a surgeon’s skill by how fast they stitch a wound.

Sandi Moon

November 25, 2025 AT 13:20Let’s not pretend this is about patient care. This is a corporate power grab disguised as cost-saving. The same conglomerates that own PBMs also own generic manufacturers. They profit when you switch - even if the patient deteriorates. The ‘biosimilar’ label? A marketing ploy. The real goal is to replace expensive biologics with cheaper, less-regulated knockoffs that can be patented again in 3 years. Wake up.

Kartik Singhal

November 26, 2025 AT 23:55Bro, the fact that people still think generics are ‘the same’ is wild. 😂 I switched my MS med to generic and my hands started shaking like I was holding a caffeine IV. They told me ‘it’s bioequivalent.’ I told them ‘my body isn’t a spreadsheet.’ 🤡

Leo Tamisch

November 27, 2025 AT 19:18There’s a deeper philosophical issue here: we treat medicine as a commodity. But when you’re managing a chronic illness, the pill isn’t just a molecule - it’s a ritual, a symbol of stability. Changing the shape, the color, the packaging - it’s not just a substitution. It’s an existential disruption. We’ve lost sight of the fact that healing isn’t just pharmacological - it’s psychological.

Simone Wood

November 28, 2025 AT 15:34OMG I just had a patient cry because her generic levothyroxine came in a different bottle and she thought they’d switched her to a ‘cheap version’ - like she was being punished for being sick?? 😭 The system is broken. We’re not just pharmacists - we’re therapists, negotiators, and trauma responders now. No one told us about this when we got our degrees.

Swati Jain

November 30, 2025 AT 08:50Y’all act like this is new. 🙄 We’ve been fighting this since 2015. The real problem? You’re all still treating generics like they’re ‘just pills.’ Nope. For NTI drugs? It’s like swapping out your car’s fuel injector with a knockoff from Alibaba. It might fit… but will it make your engine explode? 🤷♀️

Florian Moser

November 30, 2025 AT 15:52I’ve been doing MTM for specialty patients for a decade. The #1 thing that helps? Consistency. If a patient starts on a generic from Manufacturer A, keep them there. Don’t switch them to Manufacturer B because the PBM gave us a better rebate. That’s not care - that’s corporate arbitrage. Patients notice. And they trust you more when you protect them from the system.

jim cerqua

December 2, 2025 AT 11:56Let me tell you about the time a PBM forced us to switch 37 patients to a new generic insulin biosimilar because it was ‘on tier 1.’ Within 48 hours, 12 of them ended up in the ER with hypoglycemia. The PBM’s response? ‘We’ll cover the ER visit.’ No. No, no, no. You don’t get to gamble with lives and call it ‘cost optimization.’ This isn’t a spreadsheet - it’s human beings. And someone’s going to die because of this.

Donald Frantz

December 4, 2025 AT 05:47Has anyone actually looked at the FDA’s bioequivalence data for levothyroxine generics? The Cmax and AUC ranges are wider than most people realize - and they’re based on healthy volunteers, not patients with Hashimoto’s or thyroid cancer. The real issue isn’t the generic - it’s the flawed regulatory framework that treats all drugs like aspirin. We need pharmacokinetic monitoring for NTI drugs. Period.

Sammy Williams

December 4, 2025 AT 11:59Just had a patient say: ‘I don’t care if it’s cheaper - I want my old pill back.’ That’s the whole story right there. We’re not here to move units. We’re here to hold space. Maybe the real ‘generics strategy’ is just… listening.