When you pick up a prescription, you might not realize how much your copay depends on whether the drug is generic or brand name. In 2024, this difference isn’t just a small detail-it can mean the difference between paying $5 or $100 for the same medication. For millions of Americans on Medicare Part D or private insurance, understanding this split isn’t optional. It’s how you manage your health budget.

How Copay Tiers Work

Most prescription drug plans in 2024 use a tiered system. Think of it like a ladder: the lower the tier, the cheaper your out-of-pocket cost. The standard structure has four main tiers, and sometimes a fifth for specialty drugs.- Tier 1: Preferred generics - These are the cheapest. Often $0 to $5 per fill.

- Tier 2: Non-preferred generics - Slightly more expensive, usually $7-$10.

- Tier 3: Preferred brands - Brand-name drugs your plan encourages. Copays average $47.

- Tier 4: Non-preferred brands - The most expensive. Median copay: $100.

- Tier 5: Specialty drugs - For complex conditions like cancer or MS. Costs range from $150 to over $5,000 per month.

This isn’t random. It’s designed to nudge you toward cheaper options. If a generic version exists, your plan will make it cheaper to take that instead of the brand. Sometimes, it’s not even a choice-you’ll pay extra if you insist on the brand.

Medicare Part D: What You Really Pay

In 2024, over 53 million Americans were on Medicare Part D. That’s nearly one in five people. And here’s what they paid on average:- Preferred generics: $4.50 per prescription

- Non-preferred generics: $7 per prescription

- Preferred brand drugs: $47 median copay

- Non-preferred brand drugs: $100 median copay

But here’s the twist: not everyone pays a flat copay. About 89% of standalone Prescription Drug Plans (PDPs) use coinsurance instead. That means you pay a percentage of the drug’s total cost-often 22% for preferred brands and up to 47% for non-preferred ones. If your brand-name drug costs $300, that’s $66 out of pocket. For a $600 drug? $282. That’s not a copay. That’s a bill.

Medicare Advantage Prescription Drug (MA-PD) plans are different. Most use fixed copays. That means your cost is predictable. But if you’re on a PDP? You could be shocked at the pharmacy counter.

Commercial Insurance: The Wild West

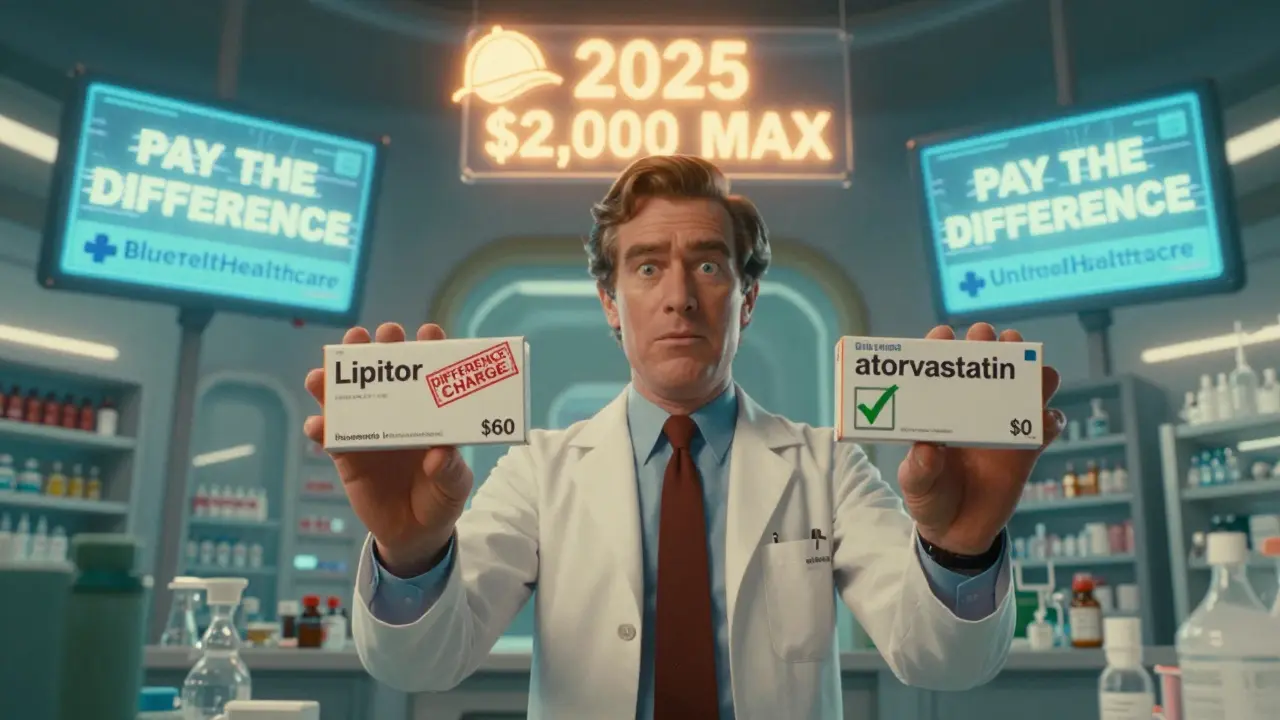

Private insurance plans don’t follow one rule. Some charge copays. Others charge coinsurance. And some? They do something called “Member Pay the Difference.”Here’s how it works: Your doctor prescribes Lipitor. Your plan says there’s a generic version-atorvastatin-that costs $10. But you want the brand. Your plan says: “Fine. Pay your normal 30% coinsurance… plus the $30 difference between the brand and the generic.” So now you’re paying $30 (coinsurance) + $30 (difference) = $60. For a drug that’s chemically identical.

This policy is legal. And it’s common. Blue Cross Blue Shield of Texas, UnitedHealthcare, and Aetna all use it. The idea is to save money. The reality? It punishes people who can’t switch drugs-because of side effects, allergies, or doctor preference.

The Real Cost Difference: Numbers That Shock

Let’s say you take one brand-name drug every month:- If it’s a preferred brand ($47 copay): $564 per year

- If it’s a non-preferred brand ($100 copay): $1,200 per year

- If you took the generic instead ($7 copay): $84 per year

That’s over $1,100 saved annually. For many, that’s rent money. Or groceries. Or a month of therapy.

And here’s the kicker: generics make up 92.7% of all prescriptions-but only 17% of total drug spending. That means 9 out of 10 pills you take are cheap. But 83% of the money spent? On the other 10% of pills: the brand names.

Medicare Part D spent $1,027 per person on generics in 2023. On brand drugs? $7,842. Per person. That’s not a typo.

What the Inflation Reduction Act Changed

The Inflation Reduction Act of 2022 didn’t just make headlines. It changed how much you pay at the pharmacy.- Insulin cap: $35 per month-no matter if it’s generic or brand.

- Out-of-pocket cap: Starting in 2025, you won’t pay more than $2,000 a year for all your drugs. That’s huge.

- Generic copays: 98% of 2025 Medicare plans will have $0 preferred generic copays. Up from 87% in 2024.

These changes are targeted. They don’t fix everything. But for people on insulin or taking multiple brand-name drugs? They’re life-changing.

Why You’re Still Paying More Than You Should

Even with these reforms, problems remain.One big issue? Tying arrangements. That’s when drug wholesalers force pharmacies to pay inflated prices for generics if they want good deals on brand drugs. Independent pharmacies say this makes it impossible to offer true cash-price discounts. So even if you pay cash, you’re still overpaying for generics.

Another? Step therapy. Your plan says: “Try the generic first.” But what if the generic gave you nausea, or didn’t work? You’re stuck in a paperwork loop. One woman in Florida told the Medicare Rights Center: “I’ve been denied three times to stay on my brand drug. My doctor says I can’t switch. But my copay’s $95.”

And then there’s the formulary gap. Just because a generic exists doesn’t mean your plan covers it. Or covers it on a low tier. You have to check your plan’s list every year.

What You Can Do Right Now

You don’t have to guess. You can find your real costs.- Use the Medicare Plan Finder. Enter your drugs. Compare plans. It updates daily.

- Ask your pharmacist. “Is there a cheaper alternative?” They often know about cash prices or discount programs.

- Check for therapeutic alternatives. 72% of Medicare plans offer a cheaper generic for at least 80% of common brand drugs.

- Don’t assume your doctor’s choice is the cheapest. Ask: “Is there a generic? Is there a preferred brand?”

- Calculate annual cost, not monthly. A $5 generic copay sounds great. But if your brand drug costs $100/month? You’re still paying $1,200 a year.

One man in Ohio switched from a $40 brand copay to a $0 generic copay. His annual drug cost dropped from $1,180 to $84. He didn’t change his health. He just changed his plan.

What’s Coming in 2025

The $2,000 annual out-of-pocket cap kicks in. That’s the biggest shift in decades. No matter how many brand drugs you take, you won’t pay more than $2,000. Period.Also: $0 preferred generic copays will be the norm. More plans will drop coinsurance for generics. And insulin will still be capped at $35.

But here’s the catch: non-preferred brand copays are projected to rise to $105. So if you’re stuck on a non-preferred drug? You’re still in the red.

The system isn’t fixed. It’s just less broken.

Real Stories: What People Are Saying

- “I pay $95 for my brand drug. The generic costs $15. My doctor won’t switch me. I’m choosing between my meds and my electric bill.” - RetireeInFlorida, MedicareInteractive.org

- “My plan charged me $42 extra because I picked Lipitor over atorvastatin. My doctor wrote ‘dispense as written.’ They still charged me.” - u/PharmaPatient, Reddit

- “I switched plans. My generics went from $10 to $0. My brand drug stayed at $47. My total drug bill dropped $700 a year.” - Medicare Plan Finder Review

These aren’t rare. In 2024, 63% of people on brand drugs said they struggled to afford them. Only 28% of people on generics said the same.

Cost isn’t just about money. It’s about health. People skip doses. Split pills. Go without. All because of a $100 copay.

Bottom Line

Generic copays in 2024 are low. Sometimes free. Brand copays? They’re not just higher-they’re often unaffordable. The gap isn’t small. It’s massive.You can’t fix your plan overnight. But you can check it. Compare it. Ask questions. And if you’re on a brand drug? Always ask: Is there a cheaper option? Because there often is.

And if you’re paying $100 a month for a drug that has a $7 generic? You’re not being smart. You’re being exploited by a system designed to save money… but only if you play by its rules.

Sanjaykumar Rabari

February 21, 2026 AT 20:43